Few industries will remain untouched by virtual and augmented reality, experts predict

In the past year alone, surgeons have begun practising their work on digital bodies, mines have been planned in immersive 3D, and Walmart Inc. has chosen to train its employees in constructed realities. Touted in the same breath as blockchain, AI and machine learning, virtual reality (VR) and augmented reality (AR) are now transforming how businesses are structured.

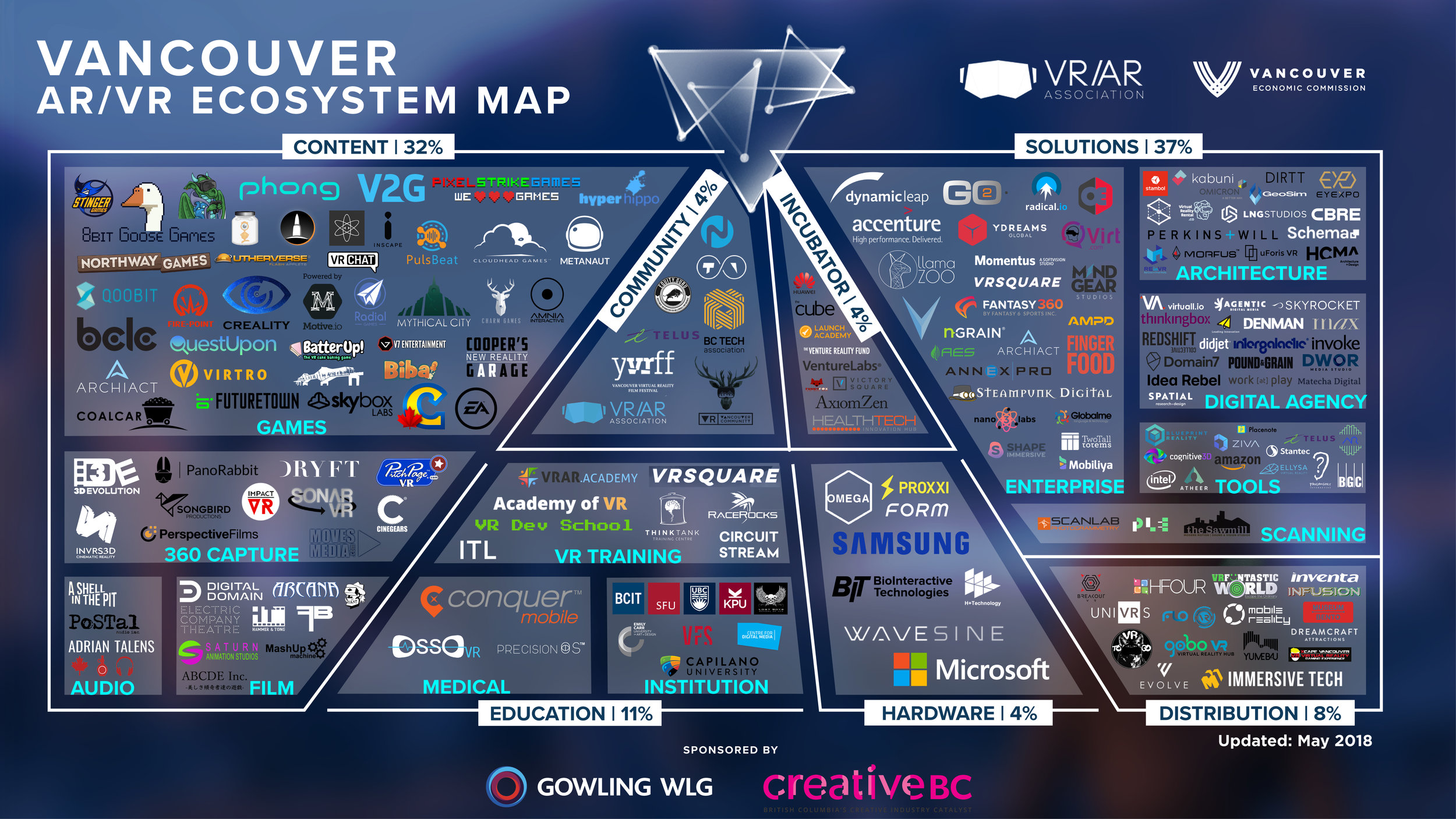

Metro Vancouver has emerged as an epicentre of the industry. For more than 40 years, the region has nurtured talent in the animation and 3D spaces—and, in its capacity as Hollywood North, has become home to some of the largest special-effects stages in North America. Upward of 180 VR and AR companies are taking advantage of that local expertise, creating enterprise solutions for sectors from retail to real estate.

It’s a boon for investors. But according to local entrepreneurs, British Columbia’s venture capitalists are missing out.

“Metro Vancouver is one of the top markets worldwide for creating VR and AR content,” says Tony Bevilacqua, founder and CEO of Cognitive 3D, a company that provides analytics on how individuals in virtual and augmented reality interact with their surroundings. “But we’re being challenged by the lack of local investment in what we would call at-risk technologies—businesses that are very research- and development-oriented, and don’t necessarily have a healthy financial outlook in the short term. If you have the metrics for a Series A round, you can raise money here. It’s in that seed stage, where a company doesn’t necessarily have the traction or numbers to show investors, that we see the biggest gaps in local funding.”

That reticence has allowed U.S. investors to plug the breach. Many Silicon Valley–based venture capitalists have funded between 10 and 30 early-stage VR and AR companies. In Canada, there are far fewer investors, and most are only supporting one startup. As a result, profits from an industry predicted to be worth up to US$215 billion by 2021, according to market intelligence provider International Data Corp., are passing local venture capitalists by.

In the view of Tom Emrich—a partner at Super Ventures, one of the few Silicon Valley AR funds that has invested in Metro Vancouver—that shouldn’t be the case.

“It’s cheaper to run a business in Canada than in the Valley, where most of the VR and AR startups are concentrated,” Emrich says. “If you’re in America, and you’re giving an American cheque to a B.C. company, that cheque is worth more in Canadian dollars. On top of that, the burn of a business—how much it’s spending on rent, electricity, and potential talent—is definitely much less than in the Bay Area.

“Canada also has a lot of grants and government programs, like SR&ED and IRAP, that help support the growth of startups,” Emrich continues. “It can extend their runway. Funds want a company to provide them with a return, and they need to survive to do that. As an investor, hearing that a government is willing to put their arms around VR and AR businesses is another benefit.”

Commentators have proposed multiple theories to explain Canada’s reservations about investing in early-stage companies. Consumer adoption of the technology has been slower than anticipated, and it’s unclear how long it might take for funds to see returns. The country’s reputation for politeness, too, means local startups are often less bold in forecasting their success and sell themselves short compared to U.S. businesses—a factor that makes them less attractive to investors.

If B.C. venture capitalists don’t choose to put their money into seed stage funding soon, though, Emrich believes the opportunity might be gone.

“The investment possibilities for this technology come early on,” he says. “As the space matures, the larger players start to hire and acquire their own solutions. When Google, Apple, Facebook and Amazon begin to put more of a focus on developing their own solutions, the startup opportunity changes, and the venture capital opportunity changes.

“I think it’s the lowest-hanging fruit if you’re in B.C. to look in your own backyard at what’s happening,” Emrich adds. “It can be part of your competitive angle as a fund to be able to identify some stellar Hootsuites, Wattpads, or Nortels early on. The Silicon Valley folks are being inundated by Silicon Valley pitches, and they might not have the luxury or time to scope out Canadian companies. If it fits your investment thesis, can you find the hidden gems that no one knows about in the area, and help support and create the tech giants of tomorrow? If so, you can reap the returns because you got in so early.”

That sentiment is echoed by Marco DeMiroz, co-founder and general partner of the Venture Reality Fund. Also based in Silicon Valley, DeMiroz has spent the past month visiting Metro Vancouver and talking with provincial government officials about the potential for investment partnerships. Currently exploring the possibility of collaborating with local venture funds or government-sponsored entities, he deems the region to be one of the world’s top VR and AR hubs.

“Collectively, VR and AR is a tremendous market opportunity, both from a hardware and software perspective,” he says. “I think the local entrepreneurs in Metro Vancouver and I would like to see more engagement from the Canadian venture capital community, just because economically and commercially, the technology has such huge potential. It’s happening, and it’s going to evolve, and investors can’t really stay out of it.”