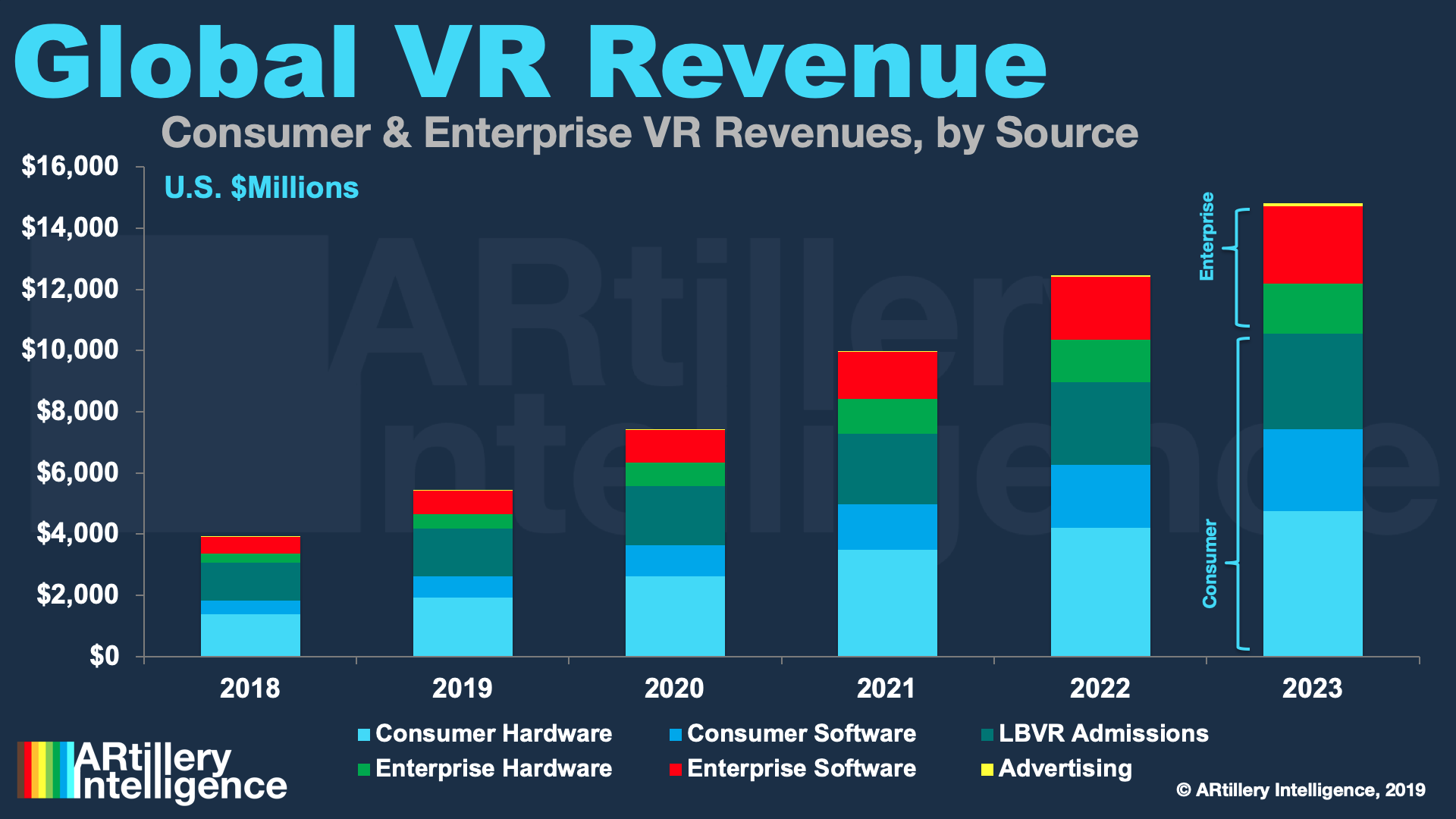

ARtillery Intelligence’s latest report, Global VR Revenue Forecast, 2018-2023 examines VR revenue performance and projections across several sub-sectors and revenue categories. Subscribe for the full report. VRARA members get a discount.

The virtual reality sector continues to show early-stage characteristics, including erratic levels of interest and investment. But how big is it, and how big will it get? ARtillery Intelligence has quantified the sector’s revenue position and outlook, resulting in our latest forecast. This is the fourth wave of ARtillery Intelligence’s VR revenue forecast.

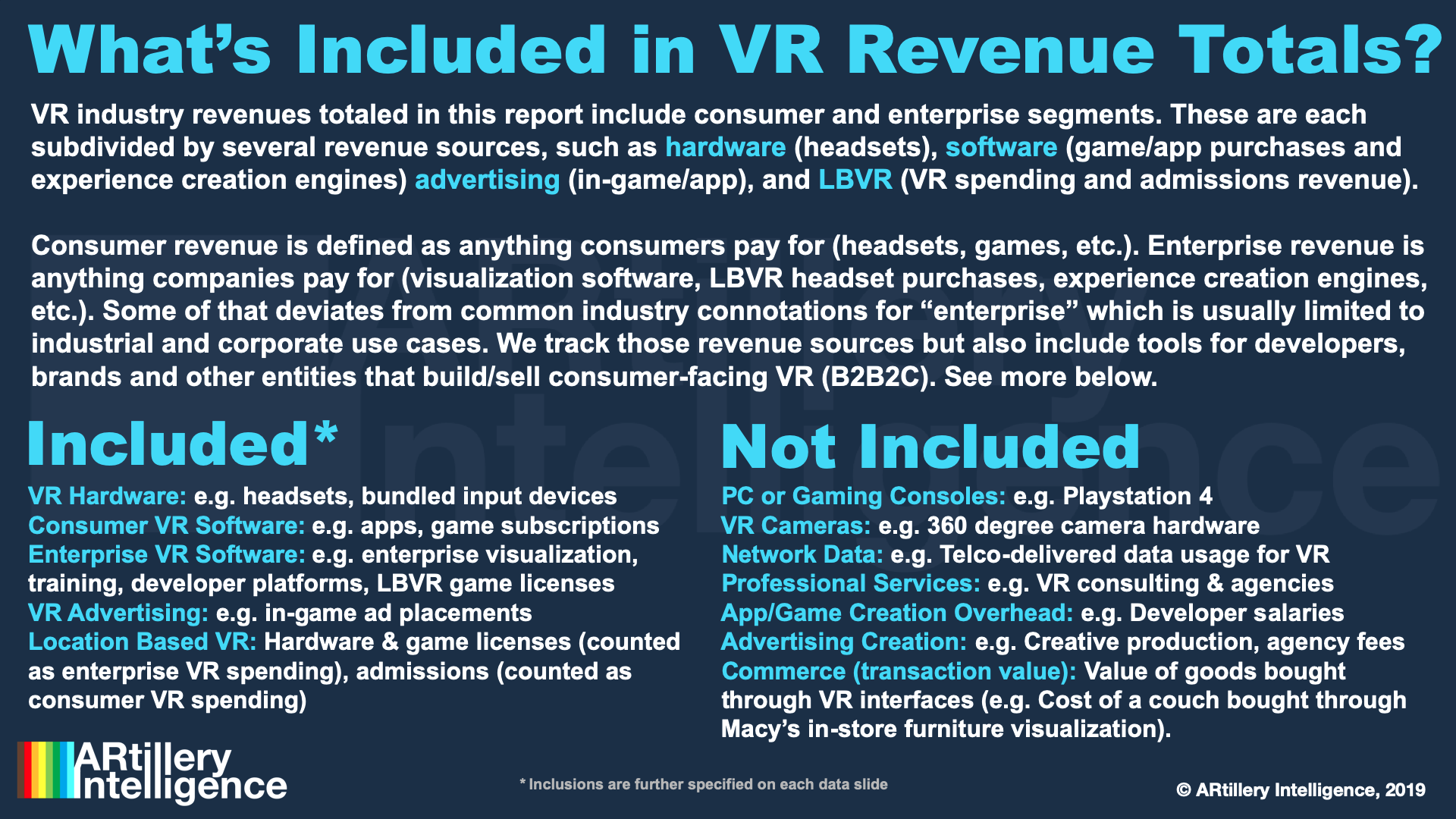

Built from daily market coverage, insider interviews and market-sizing experience from 15 years of analyst work (see methodology section), ARtillery Intelligence has constructed disciplined and independent market-sizing models. The analysis is segmented into revenue categories such as consumer, enterprise and sub-divisions of each.

So what did we find out? At a high level, ARtillery Intelligence’s position on VR revenue growth is best characterized as cautiously optimistic. Growth and scale will come, but likely slower than many industry proponents believe, due partly to the pace of adoption and other signals that ARtillery Intelligence tracks.

In fact, you may notice that VR revenue projections in outer years are lower than figures you see elsewhere. They’re also notably lower than our past estimates, as we adjust to market signals. This is common in market forecasting, as proficient market watchers perpetually course-correct based on dynamic market conditions and variables (market-sizing methodology is detailed here).

The following pages quantify and project figures within several revenue categories, as well as hardware unit growth. Bulleted insights are included throughout to qualify the revenue drivers and rationale behind the numbers. The goal, as always, is to empower you with a knowledge position.

Subscribe for the full report. VRARA members get a discount.