Get the full report and subscribe to ARtillry Insights here.

Who’s using virtual reality (VR) today? What are their motivations? What are the VR use cases and content categories that resonate most, and least? And for those who are uninterested in VR, what are their biggest reasons?

A lot can be learned about VR’s market opportunity by answering questions like these, and uncovering sentiments of the consumer public. And in VR’s early days, such data is scarce yet critical to positioning strategies.

So we set out for answers. Tapping a considerable sample of almost 2000 adults, ARtillry uncovered telling consumer behavior patterns, useful in ongoing VR strategy refinement. That includes content, hardware and other components.

See the report's key takeaways below and preview the report here. To access the full report, subscribe for ARtillry Insights.

VR Usage & Consumer Attitudes

Key Takeaways

-- Samsung’s Gear VR is VRM’s most popular headset, followed by Playstation VR (PSVR)

-- Gear VR’s success is due to its relatively low price ($129), and longer tenure in the marketplace relative to the comparable Google Daydream View.

-- PSVR’s success is due partly to its compatibility with 60 million PlayStation 4 consoles.

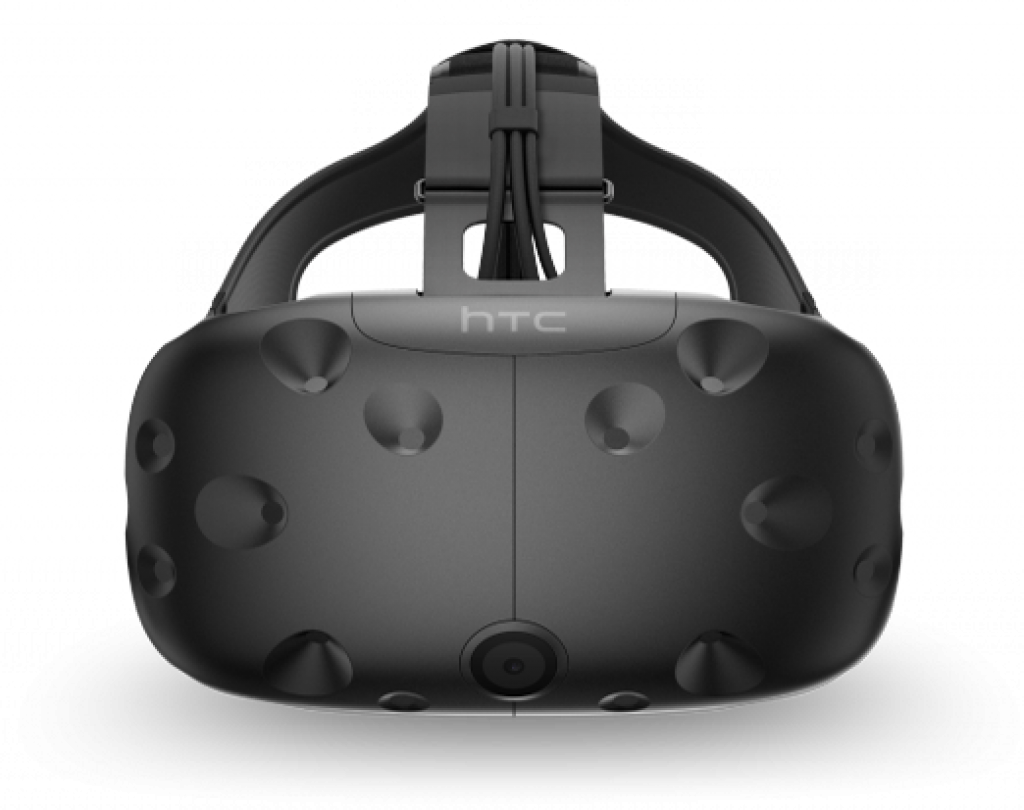

-- VR owners will pay for quality… to a point. PSVRs tier-1 benefits resonate with consumers but are also “good enough” for most, versus the more capable and expensive Rift & Vive.

-- VR satisfaction is favorable across headsets, invoking cautious optimism for VR’s future.

-- Because VR is so immersive and visceral, it incites a strong positive response.

-- This is a blessing and a curse: Though it results in high satisfaction levels, it requires direct experience that can’t be replicated in commentary or marketing.

-- The industry’s challenge is to bring technologically invasive experiences to the masses.

-- Among those uninterested in VR, the biggest reason was “just not interested.”

-- This contrasts with owners’ satisfaction, validating that you have to try VR to “get it.”

-- This indicates two key areas of improvement for VR players: education and distribution.

-- Getting that “first taste” to the masses should be a key business objective for the industry.

-- Adoption accelerants include retail installations, VR arcades and Mobile VR.

-- Among the things that VR users desire, more and better content top the list.

-- This validates that content is king in VR, just like other mediums (see enclosed video).

-- Content is currently a gap in VR’s value chain, and a business opportunity for entrants.

-- VR affinity correlates to youth, due to natural technology interest among digital natives.

-- Willingness to spend $400+ on VR equipment shows a reverse correlation to age, with one exception: Ages 25-34 are more willing than ages 18-24, likely due to spending power.

-- $400 is a significant price point, validated by Oculus’ recent pricing adjustment for Rift.

-- We’ll see more price competition: emerging sectors often trade margins for market share.

-- Top VR activities include watching movies, exploring the world, gaming and watching sports.

-- These areas are ripe for business opportunity, or synergies with existing businesses.

-- The most successful VR apps will apply native thinking: building specifically for the form factor.

-- Just like with smartphones, apps that utilize unique aspects (i.e 3D immersion) will outperform those that shoehorn legacy 2D media it into a VR experience.